Turn Your Invoices Into Cash in Under 24 Hours with Best Factoring

Unlock the value of your outstanding invoices today and infuse your business with the capital it needs to grow.

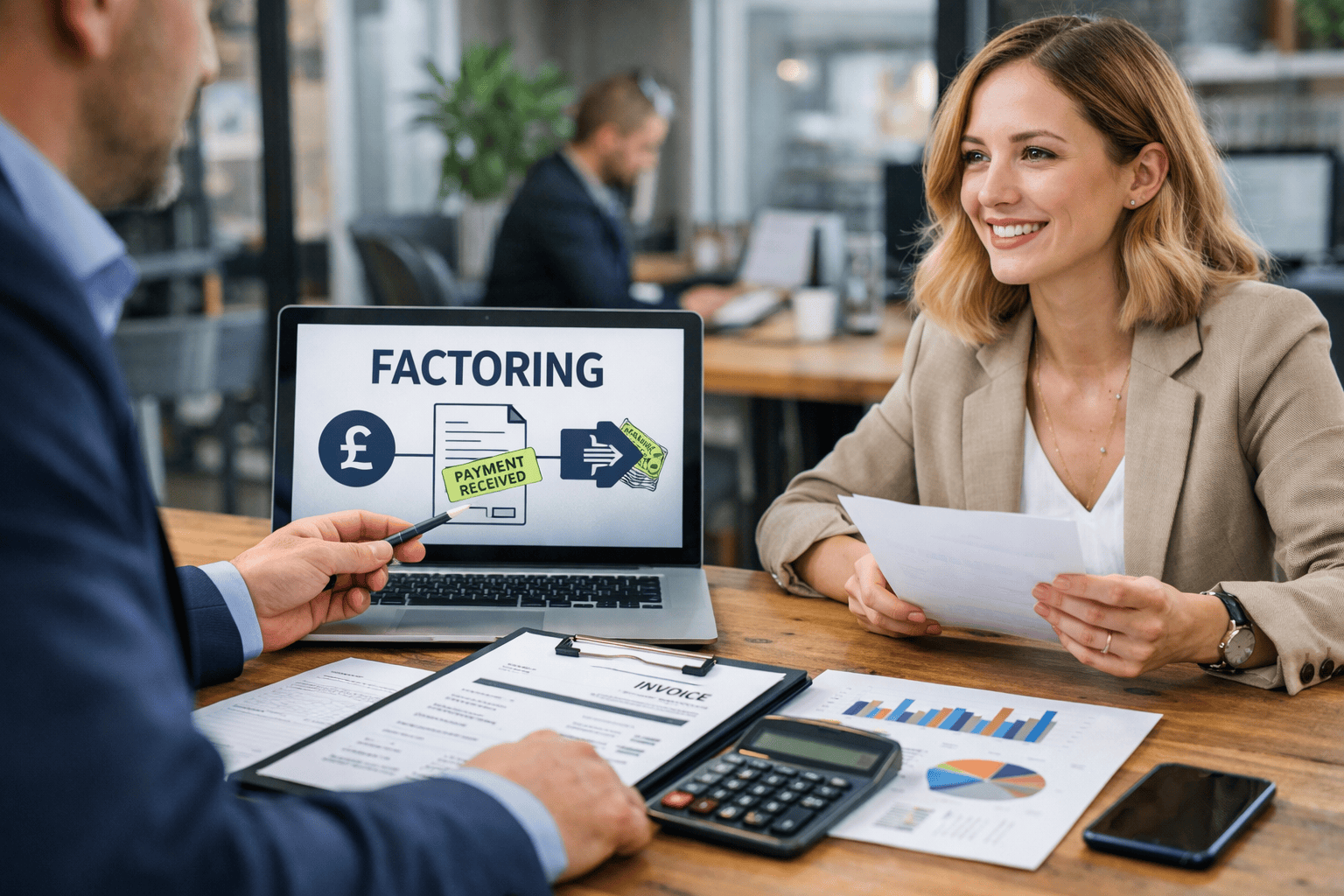

What Is Invoice Factoring?

Invoice Factoring is a reliable and effective way for businesses to improve cash flow by leveraging outstanding invoices.

This financing solution allows you to access up to 90% of the value of your unpaid invoices almost immediately, rather than waiting the usual 30, 60, or even 90 days for customers to pay. Factoring also includes managed credit control, meaning the lender will take care of collection of invoices of your behalf, often confidentially if required.

Best Factoring can help you unlock the funds tied up in your invoices so you can keep your business moving forward, without worrying about long payment terms or late payments.

The Benefits Of Invoice Factoring

Invoice Factoring is particularly beneficial for businesses that sell to other businesses on credit terms and experience long payment cycles. It’s an ideal solution for companies in industries such as manufacturing, wholesale, logistics, and staffing, where waiting for payments can significantly impact cash flow.

Businesses experiencing rapid growth or those that want to stabilize their cash flow without taking on additional debt will also find Invoice Factoring to be an attractive option. With the added benefit of the credit control being managed by the lender, freeing you up to concentrate on new opportunities to win more business.

Frequently Asked Questions

Invoice factoring is a financial arrangement where a business receives an advance on its outstanding invoices from a specialist lender. This allows the business to get immediate cash, thus improving its cash flow without incurring debt, while also allowing the credit control to be managed by the lender.

The process begins when you submit your outstanding invoices to your chosen lender. The lender then advances up to 90% of the invoice amount immediately. After your customer pays the invoice, the lender sends you the remaining balance, minus a fee for the service.

Whether your customers know about the factoring service depends on the type of factoring agreement you choose:

- Standard Factoring is disclosed, so your clients are aware you have the backing of a financial institution to help you grow and take on more business.

- Confidential Factoring allows your relationship with the lender to remain private. If the lender needs to issue reminders regarding overdue invoices, they would do so as if they are communicating from your business.

Typically, funds from factored invoices can be made available very quickly, often the same day or within 24 of submission to your lender portal.

Best Factoring have a huge lender panel so we can help fund a wide variety of industries, but there are some limitations:

- Your invoices must be from creditworthy B2B (business-to-business) customers.

- Lenders will not accept very old invoices, disputed invoices, or invoices from businesses in certain high-risk industries.

This can be checked in advance of submitting them for funding.

Why Choose Best Factoring For Your Invoice Factoring Needs

Fast Funding

Access funds within 24-48 hours. Our swift approval process ensures your business gets the capital it needs without delay.

Secure & Reliable

Trust in our transparent, secure process. We protect your information and provide consistent, reliable funding.

Support Growth

Invest in your business's future. Use the immediate cash flow to cover expenses, take on new projects, and grow your business.

Navigating the Latest Trends in Invoice Factoring

Explore how recent market changes are shaping the world of invoice factoring, and what that means for your business.

Ready to Elevate Your Cash Flow?

Whether you're scaling operations, seizing new business opportunities, or managing day-to-day expenses, Best Factoring has the financial solutions available to help. Our unrivalled lending panel can offer you immediate liquidity, personalised funding solutions and professional support to help streamline your cash flow management. This frees you up to what’s most important, growing your business.

Don't let slow-paying clients or long payment terms hold you back, unlock the value of your outstanding invoices now and contact Best Factoring for a free, no obligation consultation.

Learn More Through Expert Insights

Is Your Business Making These Money Mistakes?

Why Every UK Business Owner Needs Independent Financial Advice (Before It’s Too Late)!

Why Your Accountant Should be Your Business Partner!

Why Every UK Business Owner Needs Independent Financial Advice (Before It’s Too Late)!

3 Top Tips to Improve Your Businesses Cash Flow