How Much Is Invoice Factoring for Startups and New Businesses?

Cash flow rarely waits for permission. Rent is due. Staff expect wages. Suppliers want paying. Yet invoices can sit unpaid for 30, 60, sometimes 90 days. For startups and new businesses across the UK, that gap can feel like a tightrope walk without a safety net.

Invoice factoring often shows up as a practical answer. But the first question nearly every founder asks is simple and fair. How much is invoice factoring, really?

how much is invoice factoring

Let us unpack the costs, the logic behind them, and what a young business should expect before signing anything.

How invoice factoring works for startups

Invoice factoring turns unpaid invoices into working cash. You raise an invoice. The factoring provider advances a large percentage of its value, often within 24 hours. When your customer pays, the balance is released to you, minus the agreed fees.

For early stage businesses, this can be the difference between pausing growth and pushing forward. It also shifts the weight of credit control and collections to a specialist team, which many founders quietly appreciate.

This sits under the wider umbrella of Invoice finance, alongside options like Invoice discounting, which keeps collections in house. Factoring is usually more accessible for startups because providers manage the ledger and debtor chasing.

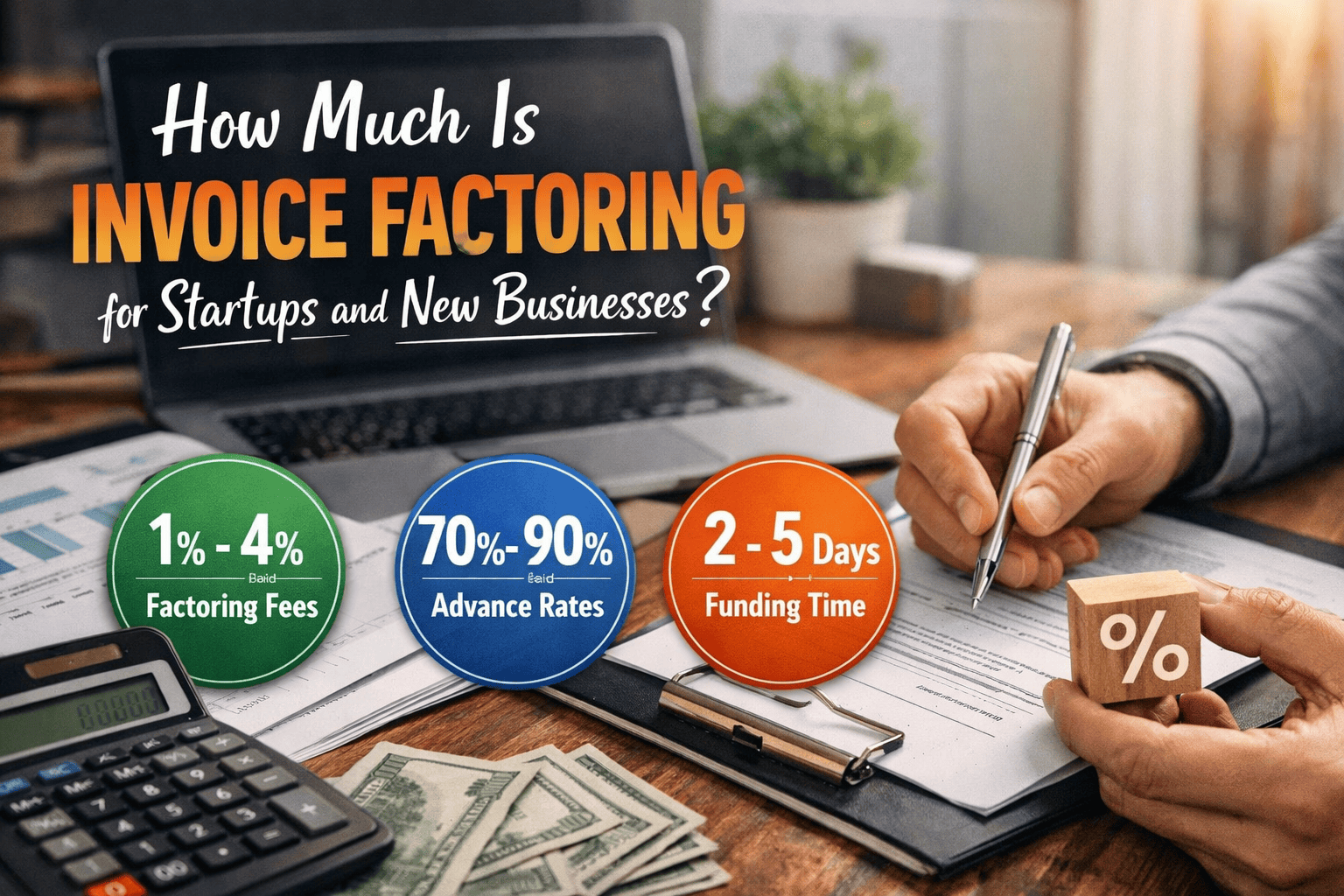

How much is invoice factoring in the UK?

The cost of invoice factoring usually comes down to two core charges. Service fees and discount fees.

Service fees explained

The service fee covers administration, credit control, and account management. For startups, this typically ranges from 0.5 percent to 3 percent of your turnover that is factored.

Why the range? Risk, invoice volume, sector, and customer quality all matter. A tech consultancy invoicing blue chip firms will land at the lower end. A young construction firm dealing with multiple small contractors may pay more.

Discount fees and interest style costs

The discount fee is the cost of accessing the cash early. It works like interest and is charged on the funds advanced, not the full invoice value.

Rates usually track a margin above the Bank of England base rate. For startups, expect something in the region of 2 percent to 4 percent above base. The faster your customers pay, the less this costs you in real terms.

Typical factoring costs for new businesses

When founders ask how much is invoice factoring in pounds and pence, the honest answer depends on usage. Still, some realistic examples help.

A startup with £50,000 in monthly invoices might receive an 85 percent advance. That is £42,500 available almost immediately. If the service fee sits at 2 percent, that is £1,000 per month. Add a discount fee that works out at £300 based on payment times.

Total cost: around £1,300 for steady cash flow and outsourced credit control. For many businesses, that trade off feels reasonable.

What influences invoice factoring pricing?

No two quotes are identical. Providers look closely at several factors before setting terms.

Your customers matter more than your age

Startups worry about limited trading history. In factoring, the spotlight often shines brighter on your customers. Strong, reliable debtors reduce risk and usually reduce cost.

Invoice volume and consistency

Higher volumes and predictable billing patterns tend to lower fees. A sporadic invoicing cycle can push costs upward.

Sector specific risk

Some industries attract higher charges due to dispute frequency or payment habits. Construction and recruitment can sit higher than professional services.

Contract length and flexibility

Shorter agreements and flexible terms can cost slightly more. Longer commitments often unlock better pricing but should only be chosen if growth plans are clear.

Invoice factoring vs invoice discounting costs

It is tempting to compare Invoice Factoring and invoice discounting on price alone. Discounting is often cheaper on paper because you retain credit control. For startups, that saving can disappear quickly if chasing payments steals time from sales or delivery.

Factoring bundles operational support with funding. Many founders value that breathing room during the early years.

Hidden costs to watch for

Transparency matters. Always ask about additional charges before committing.

These may include setup fees, minimum monthly fees, credit check charges, or early termination costs. Reputable providers explain these clearly. If answers feel vague, pause and reassess.

A good factoring partner feels like a finance ally, not a trap.

Is invoice factoring worth it for startups?

Value is not just about cost. It is about momentum.

Invoice factoring can smooth cash flow, support payroll, fund marketing pushes, and remove the stress of unpaid invoices. For UK startups navigating growth without traditional bank support, that stability often outweighs the fees.

It also avoids dilution. You are not giving away equity. You are unlocking cash already earned.

Choosing the right factoring provider in the UK

Startups benefit from providers who understand early stage realities. Flexible underwriting, clear communication, and sector experience matter.

At Best Factoring, the focus is on matching businesses with suitable invoice finance solutions, not forcing one size fits all products. That difference shows up quickly in pricing clarity and ongoing support.

Final thoughts and next steps

So, how much is invoice factoring? Enough to matter. Not so much that it should scare the right business away.

For startups and new businesses, the real cost is often standing still due to cash flow gaps. Factoring turns waiting time into working capital and gives founders space to focus on growth.

If cash flow feels tight or unpredictable, it may be time to explore invoice finance options properly. A quick conversation can reveal whether factoring fits your numbers, your customers, and your ambitions.

Reach out to Best Factoring for a tailored quote and practical guidance built around your business, not generic assumptions.

FAQs

1. Can a startup with no trading history use invoice factoring?

Ans. Yes. Many providers focus more on your customers’ credit strength than your own trading history.

2. How quickly can I access funds through invoice factoring?

Ans. Often within 24 hours of raising an invoice, once the facility is live.

3. Does invoice factoring affect customer relationships?

Ans. Handled professionally, most customers accept it as standard business practice, especially in B2B sectors.

4. Is invoice factoring more expensive than a bank overdraft?

Ans. On paper, yes. In practice, factoring is often easier to obtain and grows alongside your sales.

5. Can I switch from factoring to invoice discounting later?

Ans. Yes. Many businesses move to invoice discounting as they grow and build internal finance capacity.

Discover the Latest Trends

Stay informed with our latest articles and resources.