How Much Does Factoring Cost in the UK? Fees, Rates, and Real Examples (2026)

If you’ve ever stared at an unpaid invoice and thought, “That money is technically mine… so why can’t I use it?” you’re not alone.

Across the UK, thousands of small businesses are doing great work, landing contracts, delivering projects on time… then waiting 30, 60, even 90 days to get paid.

And that gap? That’s where cash flow stress lives.

So it makes sense that more business owners are asking the same practical question in 2026:

How much does factoring cost, really?

Not the glossy brochure version. The real-world cost, with actual numbers.

Let’s break it down properly.

How Much Does Factoring Cost in the UK?

Factoring costs in the UK usually fall into two main categories:

- Service fees (the management cost)

- Discount charges (the funding cost)

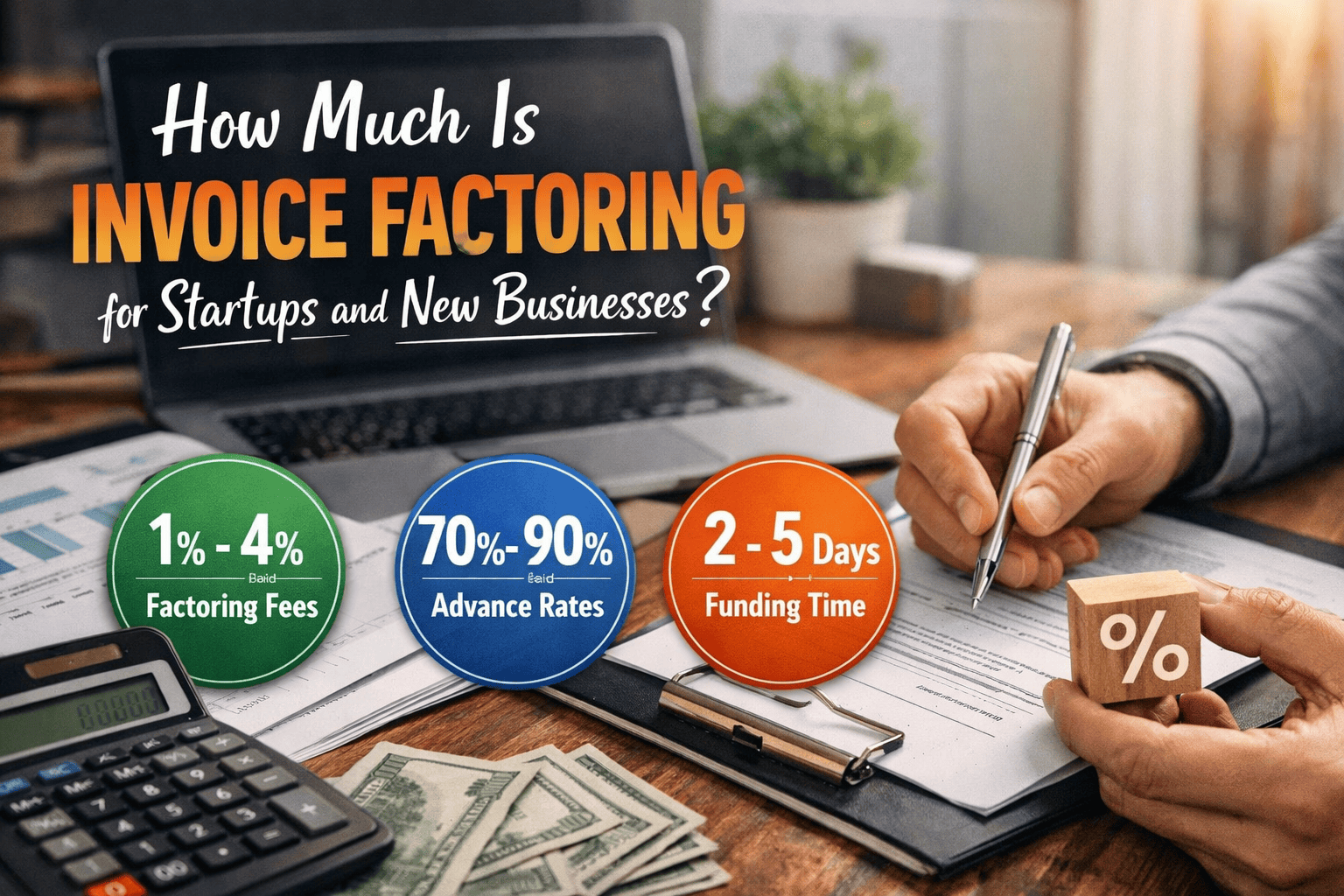

Most UK businesses will pay somewhere between:

- 1% to 5% of invoice value in service fees

- 2% to 8%+ annual interest equivalent on the funds advanced

The exact answer depends on your turnover, invoice volume, customer base, and how quickly clients pay.

Factoring isn’t a one-size-fits-all price tag. It’s more like insurance or hiring staff… it depends what you need.

The Two Core Fees You’ll Pay

1. The Factoring Service Fee

This is the fee for the factoring company managing your sales ledger, collecting payments, and running credit checks.

In the UK, service fees typically range from:

0.5% to 3% of your monthly invoiced turnover

Example:

If you invoice £100,000 per month and your service fee is 2%:

- Service fee = £2,000/month

This covers the admin side of the arrangement.

It’s basically paying someone else to chase invoices while you get on with running your business. And honestly, most owners don’t miss doing credit control.

2. The Discount Charge (Funding Fee)

This is the cost of borrowing the money upfront.

It works similarly to interest and is usually calculated above the Bank of England base rate.

Typical range:

Base rate + 2% to 6%

If you draw £50,000 for 30 days, you only pay for that period, not the whole year.

So the cost is often smaller than people expect.

Real Example: What Factoring Might Cost in Practice

Let’s make this real.

Example: A UK Recruitment Agency

- Monthly invoices: £80,000

- Advance rate: 90%

- Service fee: 2%

- Discount rate: 4% annual

Step 1: Cash Advance

90% of £80,000 = £72,000 upfront

Step 2: Service Fee

2% of £80,000 = £1,600

Step 3: Funding Cost

£72,000 borrowed for 30 days at 4% annual:

Approx funding charge = £240

Total Monthly Cost

- Service fee: £1,600

- Discount charge: £240

- Total: £1,840

That’s about 2.3% of invoice value.

And in return, the business avoids cash flow gaps, pays temps on time, and grows without panic.

Not bad, right?

Why Factoring Costs Vary So Much

If you’ve spoken to two providers and heard wildly different quotes, don’t worry. That’s normal.

Factoring prices depend on:

Your Turnover and Invoice Volume

Higher volume usually means lower fees.

The Credit Strength of Your Customers

If you invoice big, reliable companies, rates improve.

How Fast Your Customers Pay

Slow payers increase the cost slightly.

Industry Risk

Construction and logistics often price differently than consultancy.

Whether You Want Full Service or Confidential Funding

Some businesses want the whole package, others prefer something quieter.

That’s where options like Invoice finance and invoice discounting come in.

Factoring vs Invoice Discounting Costs

Many UK business owners confuse these.

Invoice Factoring

The factoring company manages collections and credit control.

Costs slightly more, but saves you time and hassle.

Invoice Discounting

You keep control of customer relationships and collections.

Usually cheaper, but you need strong internal systems.

Both fall under the umbrella of invoice finance, and the right choice depends on how hands-on you want to be.

Hidden Fees to Watch Out For

Not every quote is as clean as it should be.

Ask about:

- Setup fees

- Minimum monthly charges

- Termination fees

- Credit protection costs

- Same-day funding charges

A trustworthy provider will explain everything clearly, not bury it in paperwork.

If it feels confusing, that’s a sign to slow down.

Is Factoring Worth the Cost?

Here’s the honest answer.

Factoring isn’t just a fee. It’s a trade.

You’re trading a small percentage of invoice value for:

- Predictable cash flow

- Faster growth

- Less stress

- More working capital

- Fewer awkward phone calls chasing payments

For many SMEs, the real cost isn’t factoring.

It’s waiting.

Missed opportunities cost more than fees ever will.

Choosing the Right Provider in 2026

The cheapest quote isn’t always the best.

Look for a provider that offers:

- Transparent pricing

- Flexible contracts

- UK-based support

- Experience in your sector

- Options across invoice finance, Invoice Factoring, and invoice discounting

If you want a clear, tailored quote, Best Factoring can help you compare options without pressure.

Ready to Find Out Your Exact Factoring Cost?

Every business is different. Your invoices, customers, and funding needs deserve a proper answer, not a guess.

Visit BestFactoring.co.uk to get a fast, no-obligation quote and see what funding could look like for you.

Sometimes the biggest relief in business is simply knowing the cash is coming.

FAQs

1. How much does factoring cost for small businesses?

Ans. Most small UK businesses pay between 1% and 5% of invoice value depending on turnover and customer risk.

2. Is invoice factoring cheaper than a bank loan?

Ans. It can be, especially for growing firms that struggle with traditional lending or need flexible funding tied to sales.

3. Do factoring companies charge interest?

Ans. Yes, through a discount charge, usually base rate plus 2% to 6%, charged only on funds used.

4. Are there hidden fees with factoring?

Ans. Some providers charge setup, minimum usage, or exit fees. Always ask for a full breakdown before signing.

5. What’s the difference between factoring and invoice discounting costs?

Ans. Invoice discounting is often cheaper because you manage collections yourself, while factoring includes full credit control support.

Discover the Latest Trends

Stay informed with our latest articles and resources.